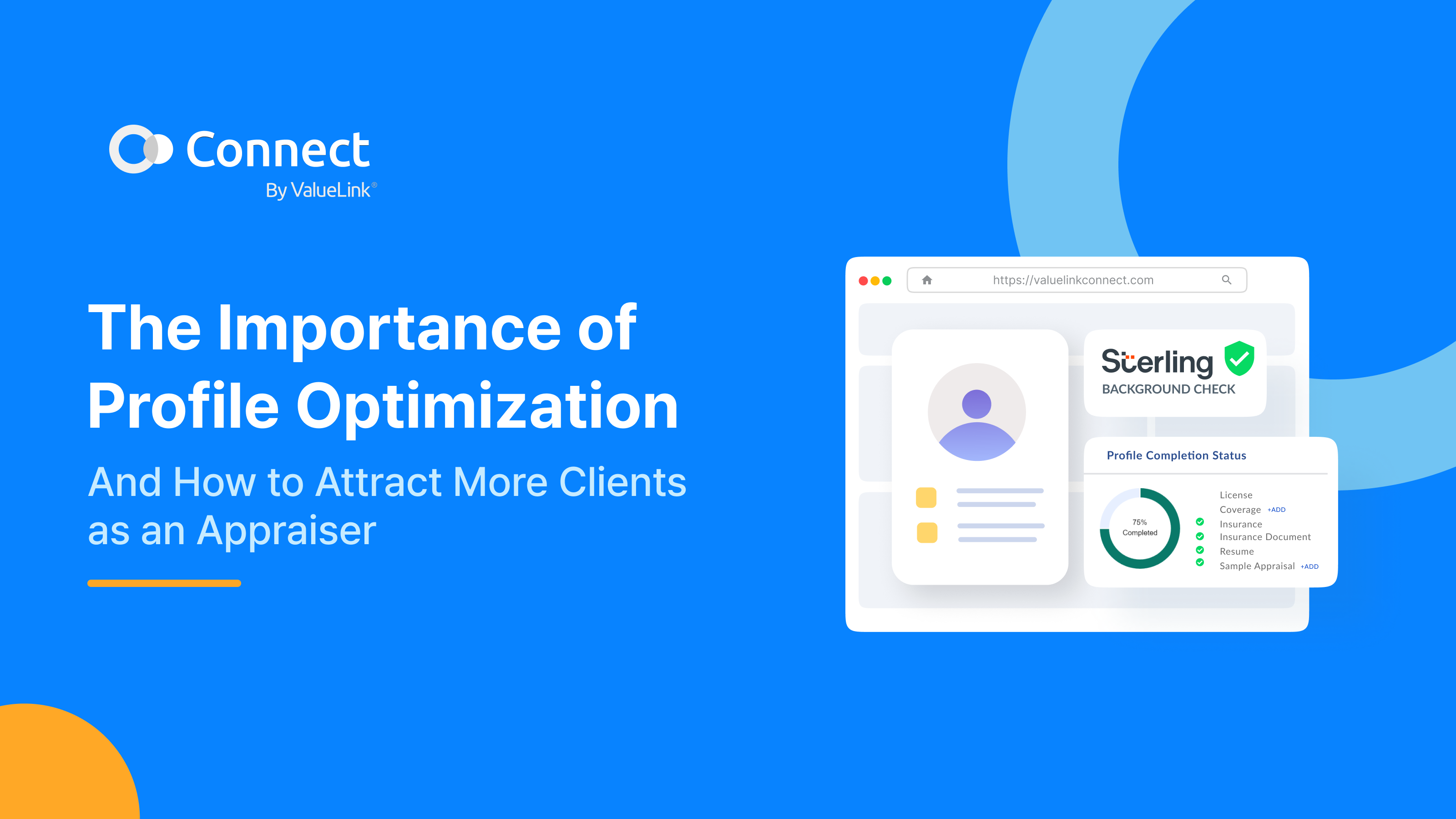

The Importance of Profile Optimization: How to Attract More Clients

As a real estate appraiser, maintaining a professional and optimized profile can significantly impact your appraisal business. Potential clients, including lenders and AMCs prioritize appraisers who demonstrate credibility, expertise, and professionalism.

This guide outlines the key elements of profile optimization and how Connect by ValueLink helps appraisers like yourself enhance their profiles to stand out, attract more clients, and grow their businesses.

Why Does Profile Optimization Matter?

Clients—whether they are AMCs or lenders—are looking for appraisers they can trust. A detailed, updated, and professional profile conveys:

- Credibility: Up-to-date licenses, insurance, and qualifications demonstrate compliance with industry standards.

- Competence: A polished profile reflects your commitment to accuracy, reliability, and quality.

- Visibility: An optimized profile makes it easier for clients to find you, especially on platforms that connect appraisers with potential assignments.

- Trust: Providing current references, coverage areas, and certifications reassures clients that you’re equipped to meet their specific needs.

Failing to maintain your profile can lead to missed opportunities and even the loss of existing clients.

The Core Components of a Winning Appraiser Profile

1. Insurance: A Shield for You and Your Clients

Insurance plays a vital role in showcasing your preparedness for potential risks and legal challenges. Clients want to work with appraisers who are not only qualified but also protected against financial liabilities.

- Errors and Omissions (E&O) Insurance:

- Purpose: Protects against legal claims arising from valuation errors, negligence, or omissions. Clients see E&O insurance for appraisers as a safeguard that ensures appraisers are ready to handle complex assignments professionally and responsibly.

- General Liability Insurance:

- Purpose: Covers claims related to third-party injuries, property damage, or reputational harm during the course of your work. General liability appraiser insurance demonstrates your commitment to professionalism and protects your business from unexpected legal or financial setbacks.

- Commercial Property Insurance:

- Purpose: Covers damages to your office, tools, and equipment due to incidents like fires, vandalism, or storms. Having commercial property insurance ensures business continuity and protects your investment in physical assets.

Having all three types of insurance up-to-date in your profile signals to clients that you are a prepared and professional appraiser who takes their responsibilities seriously.

2. Licenses: The Backbone of Your Credibility

Your licenses are non-negotiable when it comes to building trust with clients. They showcase your compliance with federal and state regulations and your ability to provide accurate, high-quality appraisals.

- Licensing Levels:

- Trainee Appraiser

- Licensed Residential Appraiser

- Certified Residential Appraiser

- Certified General Appraiser

- Ongoing Education: Maintaining your licenses often requires periodic continuing education to stay updated on evolving appraisal practices and regulations.

Clients view an updated license as a baseline requirement for trust and reliability. An expired or missing license on your profile can lead to immediate disqualification from assignments.

3. Background Checks: A Gateway to Client Confidence

Background checks are increasingly becoming a standard requirement for clients, particularly lenders and AMCs. They ensure appraisers meet regulatory and professional standards, enhancing trust and credibility, especially for new clients unfamiliar with your track record.

- Key Features to Highlight in Your Profile:

- Background check status (e.g., verified, pending).

- Verification from reputable providers like Sterling to streamline the process.

4. Coverage Area: Showcase Your Local Expertise

Clearly defining your coverage area helps clients understand where you operate and ensures you appear in relevant searches.

- Best Practices:

- List counties, cities, or regions you serve.

- Update this information whenever you expand or adjust your service area.

- Why It Matters: Highlighting your familiarity with local markets makes you a more appealing choice for region-specific assignments.

5. Qualifications: Highlighting Your Specialized Skills

Your qualifications and certifications provide clients with a clear understanding of your expertise. This includes areas like residential, commercial, USDA-qualified, or construction appraisal services.

- Why It Matters: Clients often look for appraisers with specialized skills to handle unique properties or meet specific requirements. Keeping this section detailed and updated positions you as an expert in your field.

6. Contact Information: The Basics That Matter

Accurate and professional contact information is fundamental to a strong profile. It ensures seamless communication with current and potential clients.

- Details to Include:

- Professional email address (e.g., not a generic or personal email).

- Updated phone number.

- Physical address or coverage region.

- Why It Matters: Incorrect or incomplete contact details can frustrate clients and damage your credibility. Accessibility is a key factor in securing new assignments.

7. References: Social Proof of Your Expertise

Client testimonials and professional references add weight to your profile, showcasing your track record and reliability.

- How to Leverage References:

- Include a mix of client testimonials and peer endorsements.

- Update references regularly to reflect recent projects and successes.

- Why It Matters: Clients often prioritize appraisers with proven results and recommendations from trusted sources.

Maintaining an Optimized Profile with Connect by ValueLink

Each of these elements contributes to a well-rounded professional profile that can attract more clients and foster trust. By ensuring your profile includes updated insurance, licenses, background checks, and other critical information, you present yourself as a reliable and competent appraiser.

Connect by ValueLink makes it simple, helping you stay ahead of the competition with streamlined tools and automation.

- Centralized Profile Management

Update and manage all aspects of your profile, including licenses, certifications, and insurance, from a single, easy-to-use dashboard.

- Background Check Integration

Easily initiate and track your background check status with Sterling directly within Connect, ensuring compliance and enhancing client trust.

- Expanded Client Visibility

An optimized profile on Connect gives you access to a network of 300+ clients, significantly increasing your chances of securing new assignments.

- Professional Analytics

Connect provides insights into profile performance, helping you refine your strategy to attract more clients.

Take the first step today—log in to Connect by ValueLink and unlock your full potential as an appraiser.